GENWORKS INTERNATIONAL

GENWORKS INTERNATIONAL

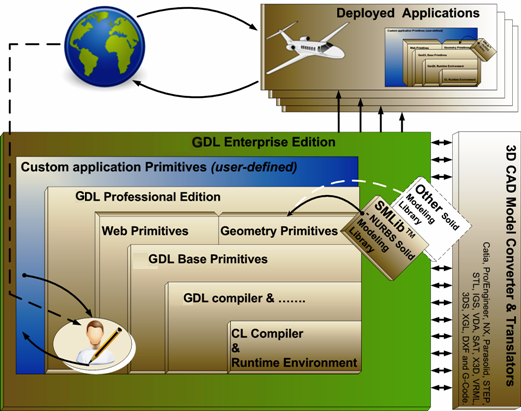

Genworks provides General-purpose Declarative Language (GDL). GDL is a high-level language and development system for solving targeted engineering problems, creating customized, special-purpose CAD systems, and other complex applications.

Disambiguation:

Genworks GDL is not to be confused with the Gnu Data Language or the Geometric Description Language.

- If you are looking for Genworks Health Private Limited (the healthcare company in India), their website is here.

Rapidly prototype applications for geometric layout, engineering, and other complex tasks using a robust environment designed to grow with you for the long term.

Declarative, Interactive Language

Genworks® GDL (built on the open-source Gendl® kernel) is a high-level, Declarative language embedded in ANSI Common Lisp, the most powerful dynamic object-oriented development system available today. Incremental compiling, updating, and debugging result in what is still the best environment for developing Knowledge Based and Artificial Intelligence applications.

Seamless Web Deployment

The GWL (Generative Web Language) Subsystem allows you immediately to share your Applications (worldwide or on a selective basis) as dynamic, Ajax-enabled web applications, for desktop or mobile platforms. The same Dynamic, Declarative paradigm is used for KBE object development (e.g. 3D geometry) as for web pages and their components --- no need to work in separate languages or paradigms to deliver production web-based solutions.

3D Solid Modeling and Rendering

GDL integrates tightly with the industry-leading SMLib Solid Modeling Kernel. With SMLib under the hood, GDL's geometric high-level primitives (HLPs) are building blocks which support assembly modeling, meshing, and rendering in several different formats, including directly in the web browser without the need for plugins.

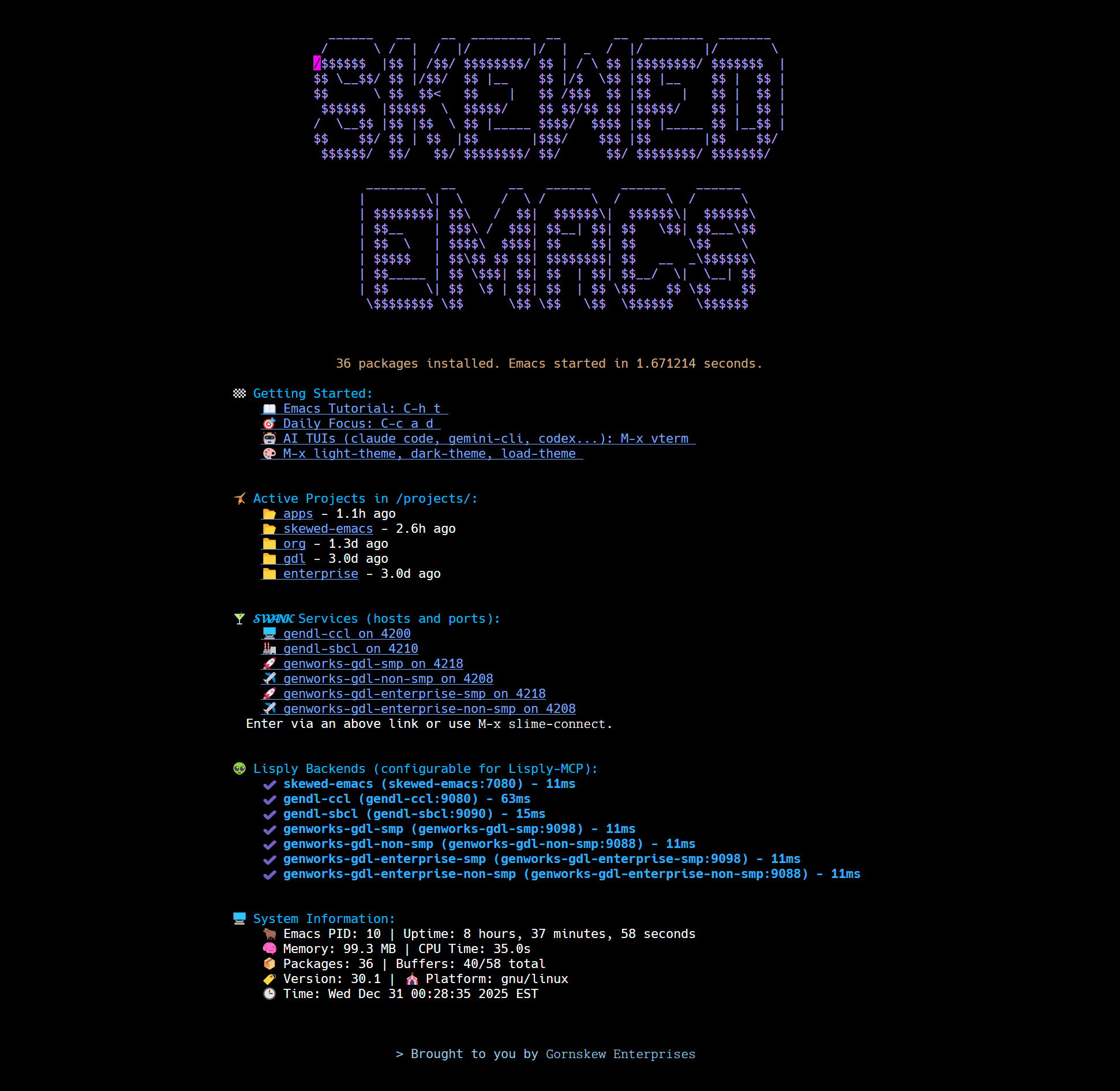

Try Live GDL Session

Experience an interactive GDL development environment directly in your browser. Connect to a live terminal and explore GDL's powerful features in real-time.